Unique capabilities

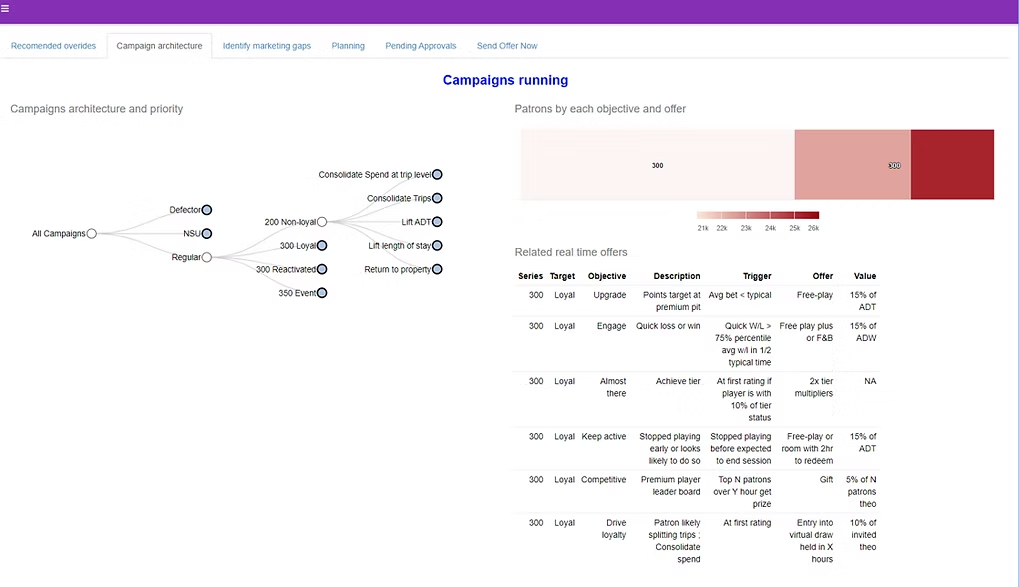

Shelf campaign library

We’ve built a library of 60+ shelf campaigns, integrated with a casino-specific lifecycle framework. Organized by objectives, these campaigns target behaviors like consolidating wallet share among non-loyal players. Each is customized by engagement level, with tailored tone, offer mechanics, and reinvestment. The library can supplement core monthly offers, as in US regional casinos, or serve as stand-alone offers in international and destination markets.

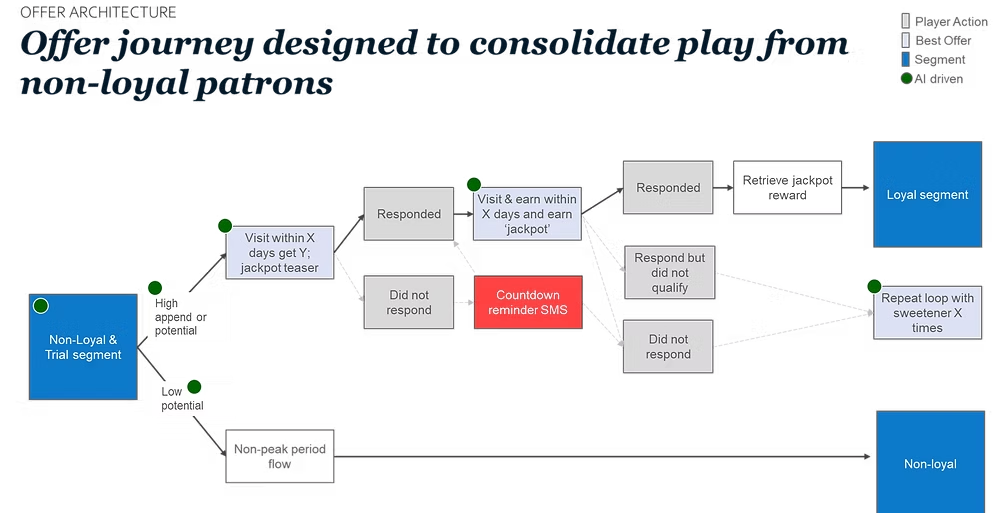

Offer journeys

We have found that a single offer rarely changes behavior long-term. For example, players often become regulars only after a third visit within a short window. To guide new sign-ups, we’ve built offer journeys that choreograph visits to the fourth trip, creating stickiness while educating them on the property. These journeys adapt reinvestment and structure for high- vs. low-potential patrons and complement the shelf campaign library across lifecycle micro-segments.

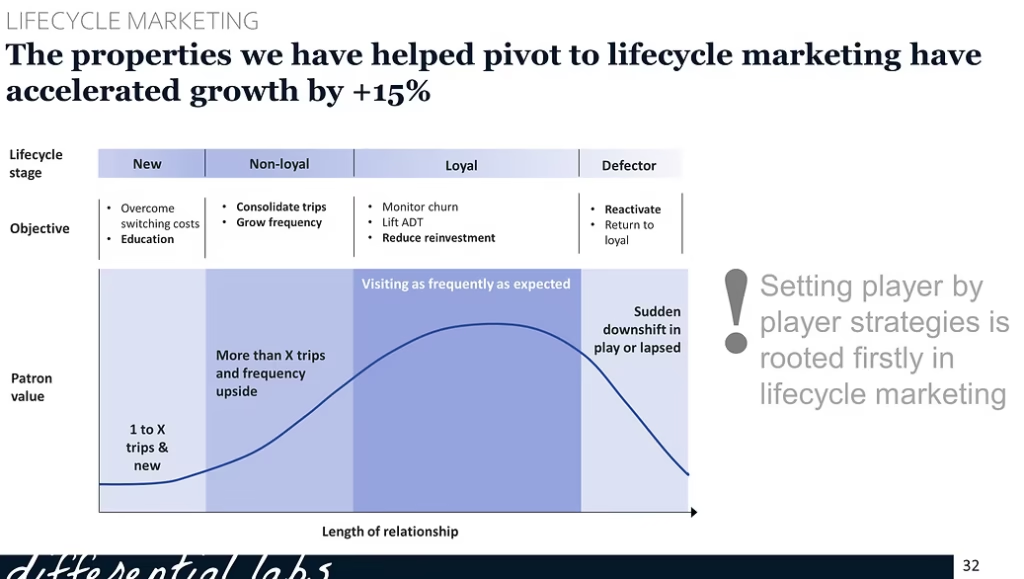

Eros: Greek for engagement

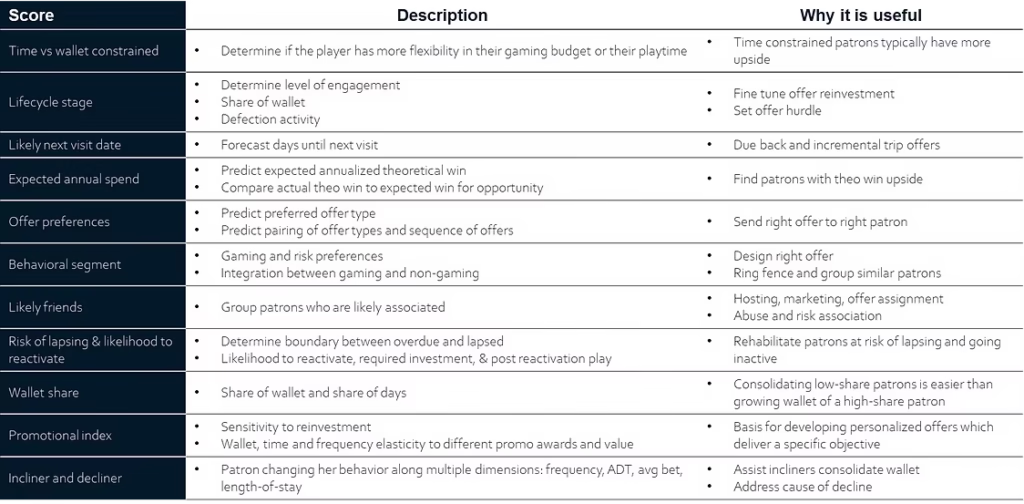

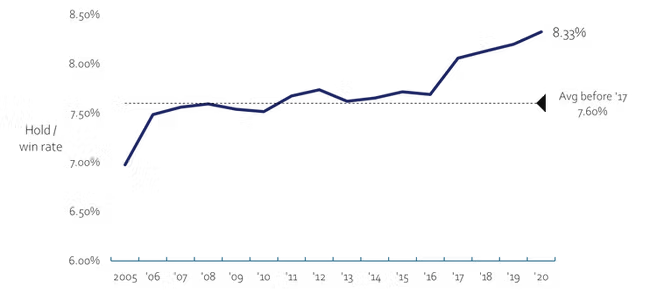

Operators that center marketing on patron engagement grow faster than the market, but doing so requires AI to identify lifecycle stage, wallet share, and patron potential. These signals differ by market—destination markets hinge on regularity, while high-frequency markets lean on wallet share, and in Macau, visitation patterns dominate. To address this, we’ve built five pre-trained “foundational” lifecycle models, collectively called Eros, that adapt to each property.

Cutting-edge casino marketing AI models

We have crafted over a dozen state-of-the-art models running on top of roughly fifty calculated features which range from drive-time to gaming propensities. Our repository is the most extensive model repository in the industry. All of the models are derived from practical experience and road tested. We are continuously improving our models and in 2020 we largely migrated to a deep learning framework which enables mass personalization that previous models could not achieve.

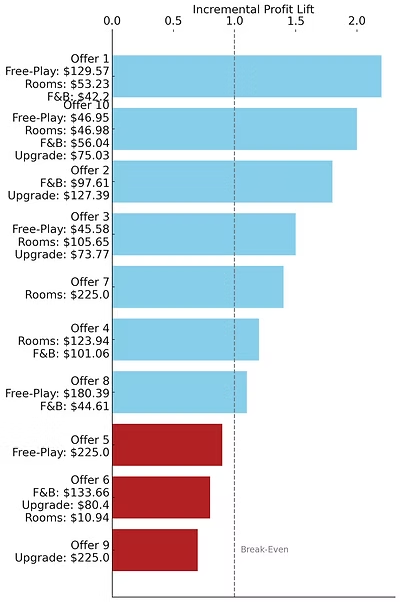

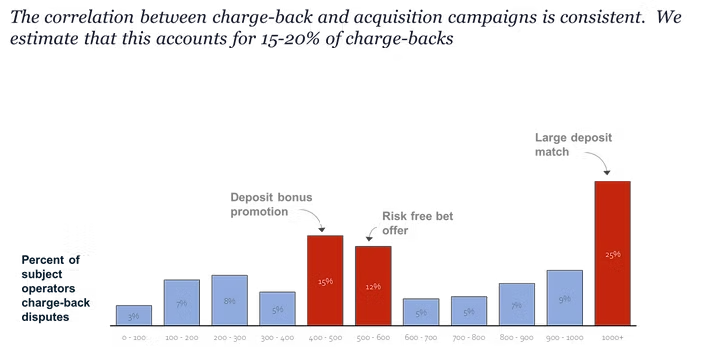

Incremental profit direct marketing model

Academics and our own proprietary analysis find generally tepid returns from direct marketing programs. In fact, the casino industry’s direct marketing ROI typically trails other industries by 15 points to 70 points! (1) Fundamental to most of our marketing engagements is our Incremental Profit direct marketing model. This model is actually an iterative suite that balances reinvestment dollars, reward types (see chart at left), and expiry periods to optimize response rates with offer structures to achieve specific objectives. We find the best long-term ROI when objectives are determined by the Eros Lifecycle model. The Incremental Profit model is fundamentally designed to either craft a patron’s trip offer (as in destination markets) or supplement core monthly offers.

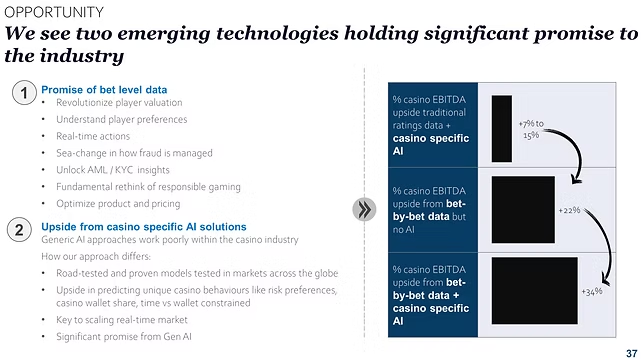

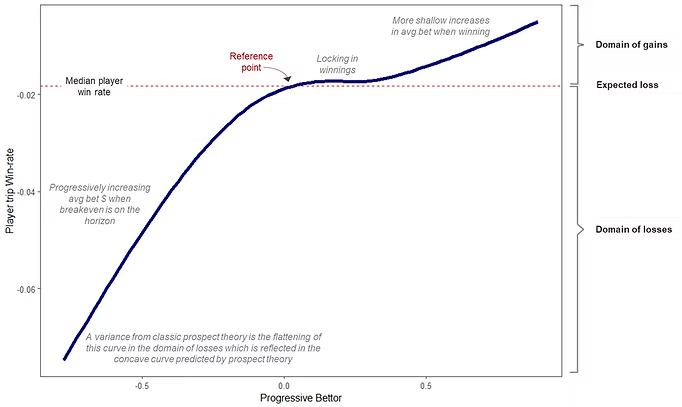

Bet by bet data

Few technologies can disrupt the casino industry like bet tracking. Traditional reliance on ratings and theoretical win overlooks how players actually experience the property. Bet tracking reveals preferences and enables real-time, context-specific engagement. We’re at the forefront of this space, using data from online, smart tables, and slots to power real-time marketing, deploy streaming AI, and detect advantage play, collusion, and rings—all in the moment.

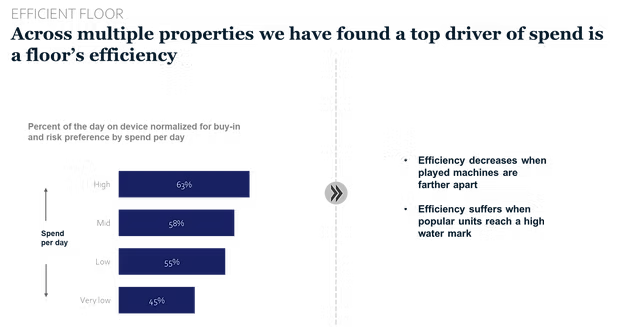

Rethinking high-end business

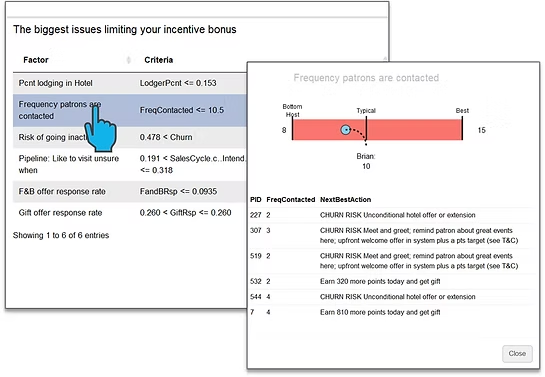

Player development (PD) reps often drive over 70% of property revenue, yet team management has changed little in 50 years. We’ve built bespoke capabilities to modernize PD across every touchpoint:

- Identifying high-potential new sign-ups even before the first rating

- Evolving the coding process to align host skills with player needs

- Integrating player communities into the coding process and special event programming

- Expanding coaching to focus on specific host behaviors (see example at right)

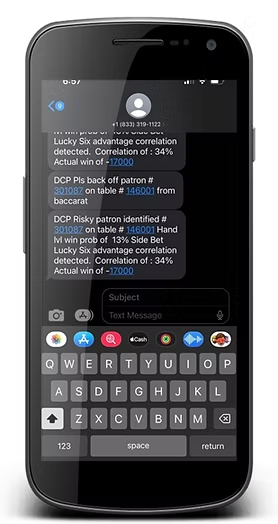

- Implementing a sales pipeline and stages leveraging AI for next-best offers and on-floor communications

- Rethinking host organization and incentive program

Real time marketing

Real-time marketing is the future, but operators often fall into traps—over-marketing, reinvestment complexity, data accuracy, and unclear timing. AI is the key to scaling effectively. Our AI orchestration pinpoints intervention moments, manages suppression, and leverages bet tracking data to maximize impact.

Responsible gaming + casino marketing

Our marketing initiatives are primarily designed to consolidate the entertainment wallet. We are excited about leveraging bet-tracking data to gain insight into pathological behaviors, ensuring a balance between risk and reward. To achieve this, we work closely with responsible gaming stakeholders to integrate research-backed harm prevention safeguards.

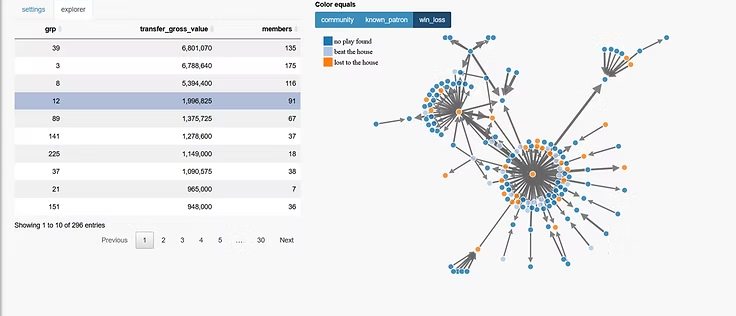

Casino social networks

- Host coding

- Identifying key influencers

- High-potential player identification

- Communities linked to an abusive player

- Discount on loss controls

Identifying unusual behaviors at scale

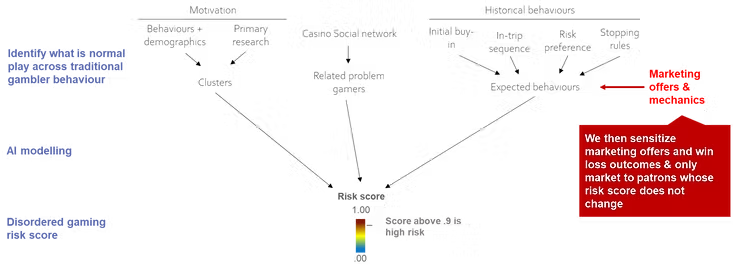

Abuse and advantage play

Advantage play is one of the most corrosive forces in the industry. Online blackjack yields a 1.5% win rate on turnover, yet in brick-and-mortar casinos it falls below 1%. Our platform builds custom count systems for any game or side bet, paired with state-of-the-art player AI to flag abusive play. These safeguards boosted one operator’s win rate by 33%, and we now automate alerts for baccarat side-bet abuse. Furthermore, because many scams rely on networks, casino social network analysis is also central to our investigations.

Play based approach to identifying AML risk

Casinos act much like financial institutions, a blind spot long flagged by the Financial Action Task Force. Current AML regulations are blunt tools, often pushing legitimate players without access to major markets underground. A more effective approach is to flag unusual play behaviors linked to laundering and use social network analysis to uncover syndicates. By closing the loop this way, casinos can better identify both risky behaviors and the individuals behind them.

Promo abuse

Reinvestment is the largest cost for most properties, yet much of it delivers low ROI. Up to a third of inefficiency comes from abuse—loopholes in promotions, over-rewarding, room on-selling in markets like Macau, and even collusion. We’ve built tools to stress-test promotions and flag unusual behaviors, helping operators reduce abuse while freeing teams to focus on creativity instead of restrictive T&Cs. We’ve also tackled online bonus fraud and chargebacks by redesigning offers.

Optimizing the casino floor

- Identifying overarching segments and setting objectives

- Assessing constrained products to maximize utility while reducing low-value use

- Districting the floor to boost efficiency while integrating amenities and marketing

- Defining RTP and jackpot strategy by district

RTP and jackpot strategy

Casino executives often debate whether lowering RTP extends playtime or boosting hold drives revenue. Our research shows most hold increases are inefficient: a 10% increase in coin-in hold typically yields only a 3% revenue lift. The real impact comes when RTP changes are guided by patron analysis and paired with free play, which delivers the strongest incremental gains. We’ve built tools to align patron needs with floor mix, base, and jackpot levers—and have applied this approach to both slots and tables, generating multi-million dollar EBITDA gains.

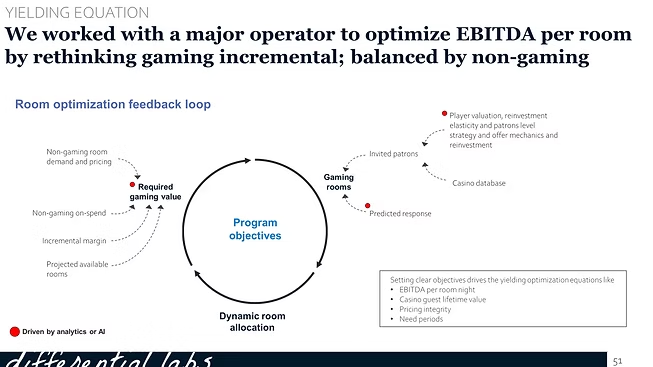

Hotel room highest and best use

If your casino hotel isn’t your best marketing tool, it should be. As non-gaming demand grows, room valuation has become more complex. On-day comping offers only a short-lived lift, while room value for gaming guests often far outweighs transient tourists. We’ve built tools to choreograph room yielding with casino marketing demand, designed to capture the non-linear effects that drive true long-term value.

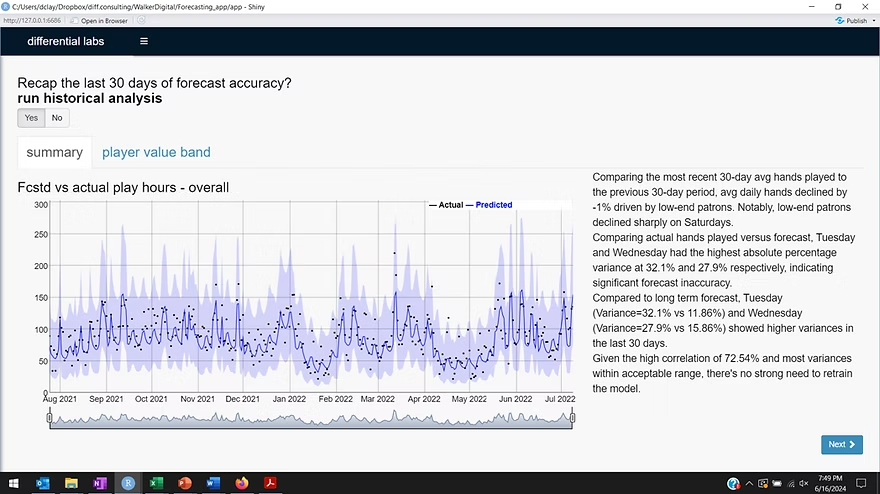

Forecasting and implications for staffing and table pricing

- Forecasting demand and where it is derived

- Accounting for player elasticities to yield table minimums and maximums

- Staffing optimization, recognizing the penalty of under-spreading is greater than added labor cost